How to invest in index funds is a crucial step towards achieving long-term financial growth. By understanding the ins and outs of index funds, you can make informed decisions that will benefit your investment portfolio. Let’s delve into this topic and explore the key aspects of investing in index funds.

Index funds have become increasingly popular due to their ability to provide broad market exposure, low fees, and consistent performance. As an investor, knowing how to navigate the world of index funds can lead to significant financial gains over time.

Introduction to Index Funds

Index funds are a type of investment fund that aims to track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, index funds passively follow the index they are based on, resulting in lower management fees and potentially higher returns over the long term.

Obtain a comprehensive document about the application of Real estate investment ideas that is effective.

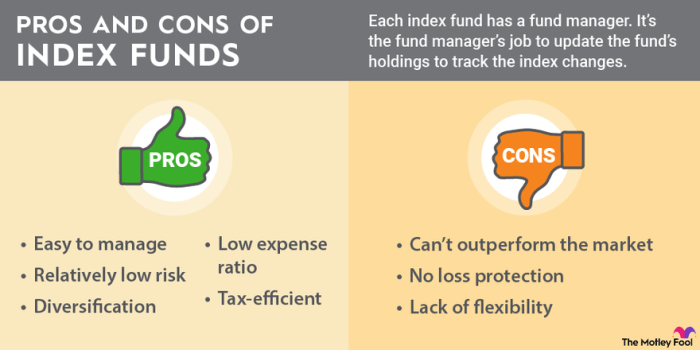

Benefits of Investing in Index Funds

- Diversification: Index funds provide instant diversification by holding a large number of stocks or bonds within the index they track.

- Low Costs: Due to their passive nature, index funds typically have lower fees compared to actively managed funds.

- Consistent Performance: Index funds tend to perform in line with the market index, offering consistent returns over time.

Popular Index Funds

- Vanguard Total Stock Market Index Fund (VTSAX): This fund tracks the performance of the CRSP US Total Market Index and provides broad exposure to the U.S. stock market.

- SPDR S&P 500 ETF (SPY): One of the most widely traded ETFs, it mirrors the performance of the S&P 500 index, consisting of 500 large-cap U.S. companies.

- iShares Core MSCI EAFE ETF (IEFA): This fund follows the MSCI EAFE Index, offering exposure to developed markets outside of North America.

Understanding Index Fund Performance: How To Invest In Index Funds

Index fund performance is typically tracked and measured by comparing its returns to the benchmark index it is designed to replicate. This comparison helps investors assess how effectively the index fund is mirroring the performance of the underlying index. The most common metrics used to evaluate index fund performance include annualized returns, standard deviation, Sharpe ratio, and tracking error.

Comparison with Actively Managed Funds

When comparing index funds to actively managed funds, it is important to consider the fees, expenses, and performance of each option. Actively managed funds are run by portfolio managers who aim to outperform the market, often through stock picking or market timing strategies. However, research has shown that over the long term, the majority of actively managed funds underperform their respective benchmarks, primarily due to higher fees and expenses.

Historical Data

Historical data showcases the growth of index funds over time, highlighting their consistent performance and low cost compared to actively managed funds. For example, over the past few decades, index funds tracking popular benchmarks like the S&P 500 have delivered competitive returns and outperformed the majority of actively managed funds. This long-term historical data reinforces the benefits of investing in index funds for many investors seeking broad market exposure at a low cost.

How to Start Investing in Index Funds

In order to start investing in index funds, individuals need to follow a few key steps to open an investment account, determine the minimum investment requirements, and choose the right index funds based on their financial goals and risk tolerance.

Opening an Investment Account

When starting to invest in index funds, the first step is to open an investment account with a brokerage firm or financial institution. This account will serve as the platform through which individuals can purchase and manage their index funds.

Minimum Investment Requirements

Different index funds may have varying minimum investment requirements. Some index funds may require a minimum initial investment of a few hundred dollars, while others may have higher minimums. It is important for investors to research and understand the specific minimum investment requirements of the index funds they are interested in before making a decision.

Choosing the Right Index Funds

When selecting index funds, it is crucial to consider one’s financial goals and risk tolerance. Investors should assess their investment objectives, time horizon, and comfort level with risk before choosing index funds. It is recommended to diversify investments across different asset classes and industries to minimize risk and maximize returns.

Diversification and Risk Management

When it comes to investing, diversification is a key strategy to manage risk. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of any negative events on your portfolio. Index funds play a crucial role in helping investors achieve diversification.

Importance of Asset Allocation, How to invest in index funds

Asset allocation is the process of dividing your investment portfolio among different asset classes such as stocks, bonds, and cash. Within an index fund portfolio, asset allocation is essential to ensure that your investments are spread out in a way that aligns with your risk tolerance and investment goals.

- Asset allocation helps minimize the impact of market volatility on your portfolio.

- By diversifying across asset classes, you can potentially reduce the risk of significant losses in a particular market sector.

- Maintaining a balanced asset allocation can help you achieve a more stable and consistent return over time.

Mitigating Risks through Diversification

Diversification can mitigate risks in investment by spreading your money across a wide range of assets. Here are some examples of how diversification works:

“Don’t put all your eggs in one basket.”

- Investing in a single stock exposes you to the risk of company-specific events. By investing in an index fund that holds a diversified portfolio of stocks, you reduce this risk.

- During economic downturns, certain sectors may perform poorly while others remain stable. Diversifying across sectors can help offset losses in one area with gains in another.

- Geopolitical events or regulatory changes can impact specific industries. Diversifying globally can reduce the impact of such events on your investments.

In conclusion, investing in index funds is a smart strategy for long-term financial success. By diversifying your portfolio, managing risks effectively, and staying informed about market trends, you can position yourself for a secure financial future. Start your journey towards investing in index funds today and reap the benefits in the years to come.