With Best robo-advisors for investments at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling ahrefs author style filled with unexpected twists and insights.

Robo-advisors have revolutionized the investment world, offering a new way to manage your portfolio with ease and efficiency. In this guide, we’ll explore the best robo-advisors available, helping you make informed decisions for your financial future.

Overview of Robo-Advisors

Robo-advisors are automated platforms that provide investment advice and manage portfolios without the need for human intervention. They use algorithms and advanced technology to create and manage diversified investment portfolios based on individual goals, risk tolerance, and time horizon. This differs from traditional investment methods, where a financial advisor or individual makes decisions on asset allocation and investment selection.

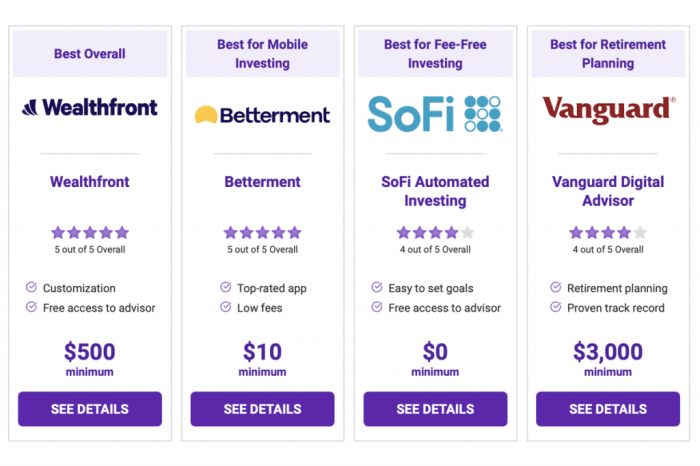

Popular Robo-Advisors in the Market

- Wealthfront: Wealthfront is known for its low fees and tax-efficient investing strategies. They offer features like tax-loss harvesting and direct indexing.

- Betterment: Betterment is one of the largest robo-advisors and offers a variety of portfolio options based on individual goals and risk tolerance. They also provide tools for retirement planning and financial goal setting.

- Ellevest: Ellevest is a robo-advisor designed specifically for women, focusing on closing the gender investing gap. They offer personalized investment portfolios based on salary, gender, and lifespan.

Benefits of Using Robo-Advisors for Investments

- Low Fees: Robo-advisors typically have lower fees compared to traditional financial advisors, making them a cost-effective option for investors.

- Diversification: Robo-advisors create diversified portfolios based on individual risk tolerance, helping to reduce risk and maximize returns.

- Convenience: Investors can easily access their investment accounts and monitor performance through user-friendly online platforms and mobile apps.

- Automated Rebalancing: Robo-advisors automatically rebalance portfolios to maintain the desired asset allocation, saving investors time and effort.

Factors to Consider When Choosing a Robo-Advisor

When selecting a robo-advisor for investment purposes, there are several key factors that investors should carefully consider to ensure the best fit for their financial goals and preferences.

Fees

- One of the most important factors to consider when choosing a robo-advisor is the fee structure. Different robo-advisors may have varying fee models, such as a percentage of assets under management or a flat fee.

- Investors should compare the fees charged by different robo-advisors to determine which option aligns best with their investment budget and long-term financial objectives.

Minimum Investment Requirements

- Another crucial factor to take into account is the minimum investment requirements set by each robo-advisor. Some platforms may have high minimums, which could be a barrier for entry for certain investors.

- Investors should evaluate their financial capacity and investment goals to choose a robo-advisor with minimum requirements that are attainable and realistic for their situation.

Investment Strategies

- It is essential to understand the investment strategies employed by different robo-advisors. Some platforms may focus on a passive indexing approach, while others may incorporate active management or socially responsible investing.

- Investors should align their investment preferences and risk tolerance with the strategies offered by robo-advisors to ensure a good fit for their financial objectives.

Transparency and Customer Service, Best robo-advisors for investments

- Transparency and customer service are vital considerations when selecting a robo-advisor. Investors should look for platforms that are transparent in their fee structures, investment processes, and performance reporting.

- Responsive customer service is also crucial, as investors may need assistance or have inquiries regarding their investments. A reliable customer support system can enhance the overall investing experience.

Investment Strategies Offered by Robo-Advisors: Best Robo-advisors For Investments

/RoboBestofPrimary-a683ffc2e1224f22a48573426705a11e.png?w=700)

Robo-advisors offer a range of investment strategies to cater to different investor preferences and financial goals. These strategies are designed to automate the investment process and create diversified portfolios efficiently.

Passive Investing

- Passive investing involves building a portfolio that mirrors a market index, such as the S&P 500, and aims to match the market performance rather than beat it.

- Robo-advisors use algorithms to allocate assets across different index funds or ETFs based on the investor’s risk tolerance and time horizon.

- By minimizing active management and focusing on low-cost index funds, passive investing can offer consistent returns over the long term.

Active Investing

- Active investing involves making frequent trades and adjustments to a portfolio in an attempt to outperform the market.

- Some robo-advisors offer actively managed portfolios that leverage algorithms to identify investment opportunities and adjust asset allocations accordingly.

- While active investing can potentially generate higher returns, it also comes with higher costs and increased risk.

Socially Responsible Investing

- Socially responsible investing (SRI) focuses on investing in companies that align with ethical or sustainable values, such as environmental stewardship or social justice.

- Robo-advisors can create SRI portfolios by excluding certain industries or companies that don’t meet specific criteria set by the investor.

- Investors can align their investments with their values while still aiming for financial growth through SRI strategies.

Robo-advisors leverage algorithms to create diversified portfolios tailored to individual risk tolerance and financial goals, providing automated investment solutions for a wide range of investors.

Performance and Returns

When it comes to evaluating robo-advisors, one of the key factors investors consider is the historical performance and returns. Understanding how robo-advisors have performed in the past can provide valuable insight into their investment strategies and efficacy.

Historical Performance Analysis

- Robo-advisors typically provide data on their historical performance, showcasing how their portfolios have fared over time.

- Investors can analyze this data to assess the consistency and growth potential of a specific robo-advisor.

- Comparing the historical performance of different robo-advisors can help investors make informed decisions based on their risk tolerance and investment goals.

Risk Management Strategies

- Robo-advisors often employ sophisticated algorithms to manage risk within their portfolios.

- They may rebalance portfolios regularly to maintain desired asset allocations and minimize risk exposure.

- In response to market changes, robo-advisors may adjust investment strategies to mitigate potential losses and optimize returns.

Tracking Investment Performance

- Investors can easily track the performance of their investments with robo-advisors through online portals or mobile apps.

- These platforms provide real-time updates on portfolio performance, including gains, losses, and overall returns.

- By monitoring their investments regularly, investors can stay informed and make any necessary adjustments to their financial goals or risk tolerance.

In conclusion, the world of robo-advisors offers a plethora of options to enhance your investment journey. Whether you’re a seasoned investor or just starting out, these automated platforms can provide the tools you need to grow your wealth. Dive into the world of robo-advisors and take control of your financial destiny today.

Understand how the union of Mutual fund investing basics can improve efficiency and productivity.