Credit card for building good credit score sets the stage for financial success, highlighting the importance of responsible credit card usage in boosting credit scores and achieving long-term financial goals.

Understanding the impact of credit cards on credit scores and exploring the types of credit cards specifically designed for building credit are crucial steps in the journey towards a healthier financial future.

Importance of Building Credit with a Credit Card

Building credit with a credit card is crucial for financial stability and future opportunities. A good credit score opens doors to better loan terms, lower interest rates, and increased chances of approval for credit applications.

Benefits of a Good Credit Score

- Access to better loan terms: A good credit score can help you secure loans with lower interest rates, saving you money in the long run.

- Higher credit limits: With a good credit score, you may qualify for higher credit limits, giving you more purchasing power.

- Approval for rental applications: Landlords often check credit scores when reviewing rental applications. A good credit score can increase your chances of being approved for a rental property.

- Lower insurance premiums: Some insurance companies use credit scores to determine premiums. A good credit score may result in lower insurance costs.

Credit Card for Establishing and Improving Credit

A credit card can be a valuable tool for establishing and improving your credit score. By using a credit card responsibly, making timely payments, and keeping your credit utilization low, you can demonstrate to lenders that you are a reliable borrower.

You also will receive the benefits of visiting Credit card balance transfer offers today.

Understanding How Credit Cards Impact Credit Scores

When it comes to building a good credit score, understanding the relationship between credit cards and credit scores is crucial. Credit cards can have a significant impact on your credit score, both positively and negatively, depending on how you use them.

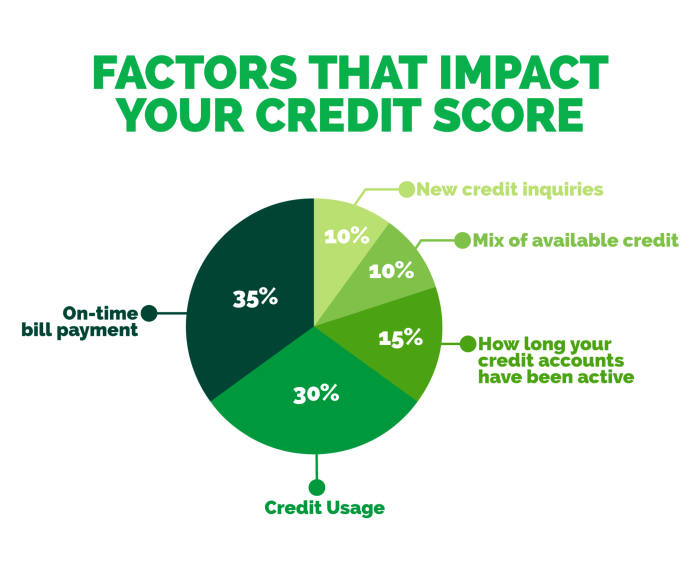

How Credit Card Usage Influences Credit Score

- Payment History: One of the most critical factors in determining your credit score is your payment history. Making on-time payments on your credit card can help boost your credit score, while late or missed payments can lower it.

- Credit Utilization Ratio: Your credit utilization ratio, which is the amount of credit you are using compared to your total credit limit, also plays a role in your credit score. Keeping this ratio low (typically below 30%) can positively impact your score.

- Length of Credit History: The length of time you have had credit accounts, including credit cards, can also affect your credit score. Keeping older credit card accounts open and in good standing can demonstrate a longer credit history, which is viewed positively by credit bureaus.

- Credit Mix: Having a diverse mix of credit accounts, including credit cards, installment loans, and mortgages, can also contribute to a higher credit score. However, it’s essential to manage these accounts responsibly.

Tips on Using Credit Cards Responsibly to Build a Good Credit Score

- Pay Your Bills on Time: Consistently making on-time payments on your credit card is crucial for maintaining a positive payment history and improving your credit score.

- Keep Your Credit Utilization Low: Aim to use only a small portion of your available credit to keep your credit utilization ratio low, which can help boost your credit score.

- Avoid Opening Too Many Accounts: Opening multiple credit card accounts within a short period can negatively impact your credit score. Be strategic about applying for new credit cards.

- Monitor Your Credit Report: Regularly review your credit report to check for any errors or fraudulent activity that could harm your credit score. Disputing inaccuracies promptly is essential for maintaining a healthy credit profile.

Types of Credit Cards for Building Credit: Credit Card For Building Good Credit Score

When it comes to building credit, choosing the right credit card can make a significant difference. Here are some types of credit cards specifically designed to help individuals improve their credit scores.

Secured Credit Cards

Secured credit cards are a popular option for individuals looking to build or rebuild their credit. These cards require a security deposit, which usually determines the credit limit. By making timely payments and keeping balances low, cardholders can demonstrate responsible credit behavior and improve their credit scores over time.

Unsecured Credit Cards for Bad Credit, Credit card for building good credit score

Unsecured credit cards for bad credit are another option for those with poor or limited credit history. These cards typically have higher interest rates and fees, but they can still help individuals establish a positive credit history when used responsibly. It’s important to carefully review the terms and conditions of these cards to avoid costly pitfalls.

Student Credit Cards

Student credit cards are designed for college students or young adults with limited credit history. These cards often come with lower credit limits and tailored benefits for students. By using a student credit card wisely, individuals can start building their credit profile early on and establish a solid foundation for future credit opportunities.

Store Credit Cards

Store credit cards are another option for building credit, especially for those who frequently shop at specific retailers. While these cards may have higher interest rates, they can be easier to qualify for and may offer rewards or discounts for loyal customers. It’s important to use store credit cards responsibly to avoid overspending and damaging your credit.

Features to Look for in a Credit Card

When choosing a credit card to build credit, it’s essential to look for features that can help enhance your credit score. Some key features to consider include low fees, a manageable credit limit, and tools for monitoring your credit activity. Additionally, look for cards that report your payment history to the major credit bureaus, as this is crucial for building a positive credit history.

Best Practices for Using a Credit Card to Improve Credit Score

When it comes to using a credit card to improve your credit score, there are some best practices you should follow to ensure you are on the right track. By understanding these strategies, you can build and maintain a positive credit history effectively.

Step-by-Step Guide on Using a Credit Card to Build Credit

- Start by applying for a secured credit card if you have no credit history or a poor credit score.

- Make small purchases with your credit card and aim to pay off the balance in full each month.

- Avoid maxing out your credit card limit and keep your credit utilization ratio below 30%.

- Monitor your credit card statements regularly to detect any fraudulent activity or errors.

- Set up automatic payments or reminders to ensure you never miss a payment deadline.

Strategies for Making Timely Payments and Maintaining a Low Credit Utilization Ratio

- Pay your credit card bill on time every month to avoid late fees and negative marks on your credit report.

- Aim to keep your credit utilization ratio low by only using a small portion of your available credit.

- If possible, pay off your credit card balance in full each month to avoid accruing high-interest charges.

- Avoid opening multiple credit accounts within a short period as it can lower your average account age and impact your credit score.

How to Monitor Credit Score Progress While Using a Credit Card Responsibly

- Sign up for a credit monitoring service to track changes in your credit score and receive alerts for any significant fluctuations.

- Regularly review your credit report for inaccuracies or suspicious activity that could affect your credit score.

- Understand the factors that influence your credit score, such as payment history, credit utilization, and credit mix.

- Consider using credit score simulators to see how different financial decisions could impact your credit score in the future.

In conclusion, utilizing a credit card strategically to enhance credit score requires diligence and responsible financial habits. By following best practices and staying informed about credit score progress, individuals can pave the way for a brighter financial future.