Credit card payment strategies are essential for effectively managing your credit card debt, impacting your credit score, and improving your financial health. In this guide, we will explore different strategies to help you navigate the world of credit card payments with ease.

Importance of Credit Card Payment Strategies

Having a solid payment strategy is crucial for managing credit card debt effectively. By implementing the right approach, individuals can avoid high interest charges, improve their credit scores, and ultimately achieve financial stability.

Remember to click Credit cards for online purchases to understand more comprehensive aspects of the Credit cards for online purchases topic.

Impact on Credit Scores

Different payment strategies can have a significant impact on credit scores. Making timely payments and paying more than the minimum amount due each month can boost credit scores by demonstrating responsible financial behavior. On the other hand, consistently missing payments or only making minimum payments can lower credit scores and lead to higher interest charges over time.

Benefits of More than Minimum Payments

- Reduced Interest Costs: By paying more than the minimum amount due, individuals can reduce the total interest costs incurred on their credit card balances.

- Faster Debt Repayment: Making larger payments allows individuals to pay off their credit card debt more quickly, freeing up financial resources for other goals.

- Improved Credit Score: Regularly paying more than the minimum amount demonstrates financial responsibility and can lead to an improved credit score over time.

Types of Credit Card Payment Strategies

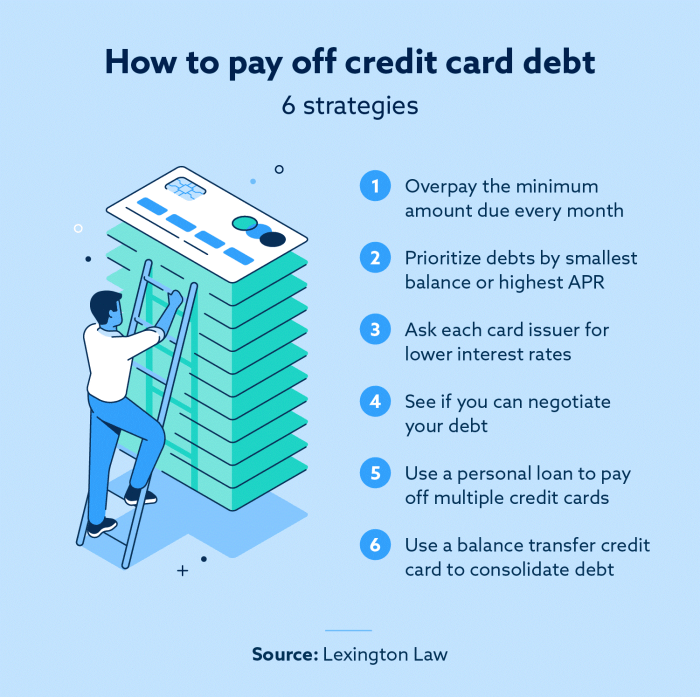

When it comes to managing credit card debt, there are different strategies that can help you pay off your balances efficiently. Two popular methods are the snowball and avalanche techniques, which offer distinct approaches to debt repayment.

Snowball Method vs. Avalanche Method

The snowball method involves paying off your debts from smallest to largest regardless of interest rates, while the avalanche method focuses on tackling debts with the highest interest rates first. Here is a comparison of the two:

- Snowball Method: This approach can provide a psychological boost as you see smaller debts being paid off quickly, motivating you to continue. However, you may end up paying more in interest over time.

- Avalanche Method: By targeting high-interest debts first, you can potentially save money on interest payments in the long run. This method is more cost-effective but may require patience as larger debts take longer to eliminate.

Benefits of Setting Up Automatic Payments, Credit card payment strategies

Setting up automatic payments for your credit card bills can offer several advantages:

- Ensures timely payments, reducing the risk of late fees and negative impacts on your credit score.

- Helps you stay organized and disciplined in managing your finances by eliminating the need to remember due dates.

- Provides convenience and peace of mind, knowing that your bills are being taken care of without manual intervention.

Tips on Prioritizing Credit Card Debts

When deciding which credit card debts to pay off first, consider the following tips:

- Start by making at least the minimum payments on all your cards to avoid penalties and further debt accumulation.

- Focus on high-interest debts to minimize interest costs and expedite your journey to becoming debt-free.

- Consider the snowball or avalanche method based on your financial goals and personal motivation factors.

Utilizing Balance Transfers and Consolidation

When it comes to managing credit card debt, utilizing balance transfers and consolidation strategies can be effective in reducing interest payments and simplifying debt repayment. Let’s explore how these strategies work and their potential benefits and risks.

How Balance Transfers Work and Benefits

Balance transfers involve moving existing credit card debt from one card to another with a lower interest rate. By doing so, you can potentially save money on interest payments and pay off your debt faster. This can be beneficial for individuals looking to consolidate multiple high-interest credit card balances into one lower-rate account.

- Look for credit card offers with low or 0% introductory APR on balance transfers.

- Transfer your high-interest balances to the new card to take advantage of the lower rate.

- Make sure to pay off the transferred balance within the promotional period to avoid accruing high interest.

Consolidating Credit Card Debt for Easier Management

Debt consolidation involves combining multiple debts into a single loan or credit account, making it easier to track and manage payments. This can help simplify your finances and potentially lower your overall interest rate.

- Consider taking out a personal loan or using a balance transfer credit card to consolidate your credit card debt.

- Create a repayment plan to pay off the consolidated debt over time, focusing on high-interest balances first.

- Avoid accumulating new debt while consolidating to prevent worsening your financial situation.

Risks of Balance Transfers and Debt Consolidation

While balance transfers and debt consolidation can be effective debt management strategies, there are potential risks to consider. These include:

- Balance transfer fees and interest rates that may increase after the promotional period.

- Potential damage to your credit score if you close old credit card accounts after transferring balances.

- Risk of accumulating more debt if spending habits are not addressed and controlled.

Managing Credit Card Payments Effectively

Effective management of credit card payments is crucial to maintaining a healthy financial standing and avoiding unnecessary fees or penalties. By following some key strategies, individuals can ensure they stay on top of their credit card payments and avoid common pitfalls.

Avoiding Late Payments and Consequences

Late payments can result in hefty fees, increased interest rates, and negative impacts on credit scores. To avoid these consequences, it is essential to set up automatic payments or reminders to ensure bills are paid on time. Additionally, creating a budget and monitoring spending can help individuals stay on track with their payments and avoid falling behind.

Monitoring Credit Card Statements for Accuracy

It is important to regularly review credit card statements for any errors or unauthorized charges. By staying vigilant and catching mistakes early, individuals can prevent potential issues that may arise from inaccurate billing. Reporting any discrepancies to the credit card company promptly can help resolve these issues and prevent further complications.

Negotiating Lower Interest Rates or Fees

Individuals can potentially lower their interest rates or fees by contacting their credit card companies and negotiating better terms. This may involve requesting a lower interest rate based on a good payment history or exploring options for fee waivers or reductions. By advocating for themselves and demonstrating financial responsibility, individuals may be able to secure more favorable terms with their credit card providers.

In conclusion, mastering credit card payment strategies can lead to financial stability, improved credit scores, and a debt-free future. By implementing the tips and techniques discussed in this guide, you can take control of your finances and achieve your monetary goals.