With Risk vs reward in investments at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

When it comes to making investment decisions, the balance between risk and reward plays a crucial role in determining the outcomes. Understanding how these two factors are intertwined is essential for any investor looking to navigate the complex world of financial markets.

Understanding Risk and Reward

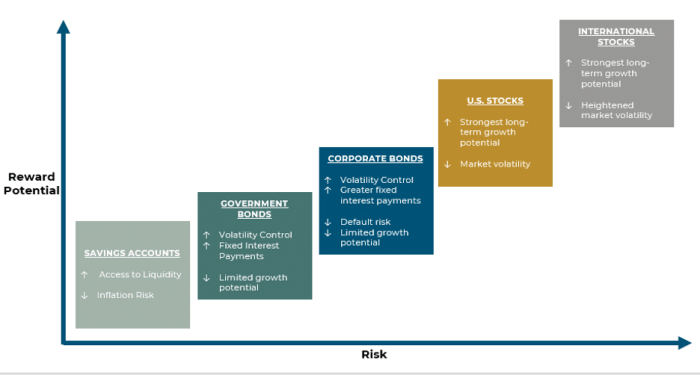

When it comes to investments, risk and reward are two crucial elements that every investor must consider. Risk refers to the uncertainty or potential for loss associated with an investment, while reward represents the potential return or profit that can be gained. These two factors are inherently linked in investment decisions, as higher potential rewards often come with higher levels of risk.

High-Risk, High-Reward Investments

High-risk, high-reward investments are those that have the potential for significant returns but also carry a higher chance of loss. These investments typically involve volatile markets, speculative assets, or emerging industries. Examples include investing in startups, penny stocks, or cryptocurrencies. While the potential for substantial gains is present, the risk of losing a significant portion of the investment is also high.

Find out about how Risk management in investment can deliver the best answers for your issues.

Low-Risk, Low-Reward Investments

On the other hand, low-risk, low-reward investments are characterized by lower levels of risk and correspondingly lower potential returns. These investments are usually found in more stable markets, established companies, or traditional assets like bonds or blue-chip stocks. While the potential for high returns may be limited, the likelihood of loss is also reduced, making them suitable for more conservative investors seeking steady growth.

Types of Investment Risks

Investing in the financial markets comes with various types of risks that investors need to be aware of in order to make informed decisions. Understanding these risks is crucial for managing investment portfolios effectively.

Market Risk

Market risk, also known as systematic risk, refers to the potential for investments to be affected by macroeconomic factors such as economic conditions, geopolitical events, and market volatility. This type of risk impacts all investments in a particular market or asset class, regardless of individual company performance. For example, a sudden market downturn can lead to a decrease in the value of stocks and other securities.

Credit Risk

Credit risk is the risk of loss due to a borrower or issuer failing to meet their financial obligations. This risk is particularly relevant in fixed-income investments such as bonds, where the issuer may default on interest payments or fail to repay the principal amount. Investors face credit risk when investing in corporate bonds, municipal bonds, or other debt instruments.

Inflation Risk

Inflation risk, also known as purchasing power risk, refers to the possibility that the returns on investments may not keep pace with the rate of inflation. Inflation erodes the real value of money over time, reducing the purchasing power of investment returns. This risk is especially relevant for long-term investments where the impact of inflation can significantly diminish overall returns.

Interest Rate Risk

Interest rate risk is the risk of changes in interest rates impacting the value of fixed-income securities. When interest rates rise, the value of existing bonds decreases, as newer bonds offer higher yields. Conversely, when interest rates fall, the value of existing bonds increases. Investors in bonds and other interest-sensitive securities are exposed to interest rate risk, which can affect the overall performance of their investment portfolios.

Strategies for Managing Risk

Diversification and asset allocation are key strategies in managing investment risks. These techniques help investors balance risk and reward while considering their risk tolerance.

Diversification as a Strategy to Mitigate Investment Risks

Diversification involves spreading investments across different asset classes, industries, and geographical regions to reduce the impact of any single investment’s performance on the overall portfolio. By diversifying, investors can lower the risk of significant losses if one sector or asset class underperforms.

- Diversification helps minimize concentration risk by avoiding overexposure to a single investment or sector.

- Investors can achieve diversification through various investment vehicles such as mutual funds, exchange-traded funds (ETFs), or index funds.

- By diversifying, investors can potentially improve the risk-return profile of their portfolios.

Asset Allocation for Balancing Risk and Reward, Risk vs reward in investments

Asset allocation involves determining the right mix of asset classes (e.g., stocks, bonds, real estate) based on an investor’s financial goals, time horizon, and risk tolerance. It aims to optimize returns while managing risk effectively.

- Asset allocation allows investors to spread their investments across different categories with varying levels of risk and return potential.

- By diversifying across asset classes, investors can achieve a more balanced portfolio that aligns with their risk appetite and investment objectives.

- Regularly reviewing and adjusting asset allocation based on changing market conditions and personal financial goals is crucial for long-term investment success.

Role of Risk Tolerance in Developing an Investment Strategy

Risk tolerance refers to an investor’s ability and willingness to withstand fluctuations in the value of their investments. Understanding one’s risk tolerance is essential in creating an investment strategy that aligns with their comfort level and financial objectives.

- Investors with a higher risk tolerance may opt for more aggressive investment strategies with higher potential returns but also greater volatility.

- Conversely, investors with a lower risk tolerance may prefer conservative strategies that prioritize capital preservation over high returns.

- Evaluating risk tolerance helps investors determine an appropriate asset allocation and investment approach that suits their individual preferences and financial circumstances.

Evaluating Potential Rewards: Risk Vs Reward In Investments

When considering an investment opportunity, it is crucial to assess the potential rewards that can be gained. This involves conducting a thorough analysis and research to understand the possible returns on investment.

Assessing Potential Rewards

- One key factor in evaluating potential rewards is looking at the past performance of the investment. Understanding how the asset has performed in the past can give insights into its potential for future growth.

- Industry trends play a significant role in determining potential rewards. Investing in sectors that are experiencing growth and have promising future prospects can lead to higher returns.

- Economic conditions also influence potential rewards. A strong economy can create favorable conditions for investments, while a downturn may pose risks to potential returns.

- It is essential to consider the risk-return tradeoff when evaluating potential rewards. Investments with higher potential rewards often come with greater risks, so it is crucial to strike a balance that aligns with your risk tolerance.

In conclusion, managing risk and evaluating potential rewards are key components of successful investing. By implementing strategies to mitigate risks and conducting thorough research, investors can maximize their chances of achieving favorable returns. Remember, the path to financial success often involves walking the tightrope between risk and reward with caution and calculated precision.