How to track your investments sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Understanding the importance of investment tracking, different types of investments to monitor, tools and platforms for effective tracking, setting up a tracking system, monitoring investment performance, and tracking taxes and fees are key components of this guide.

Understanding Investment Tracking

Investment tracking is a crucial practice for individuals looking to manage their finances effectively. By monitoring your investments regularly, you can gain valuable insights into the performance of your portfolio and make informed decisions to optimize your returns.

The Importance of Tracking Investments

- Allows you to evaluate the performance of your investments over time.

- Helps you identify underperforming assets and make adjustments accordingly.

- Enables you to stay informed about market trends and economic conditions that may impact your investments.

The Benefits of Actively Monitoring Investment Performance

- Opportunity to capitalize on potential gains and minimize losses.

- Enhanced control over your financial future by making data-driven decisions.

- Ability to rebalance your portfolio to align with your financial goals and risk tolerance.

The Risks of Not Tracking Investments Regularly

- Missed opportunities for growth and wealth accumulation.

- Increased exposure to market volatility and potential losses.

- Lack of awareness regarding changes in your investment performance and overall financial health.

Types of Investments to Track: How To Track Your Investments

When it comes to tracking investments, individuals have various types to keep an eye on. These include stocks, bonds, mutual funds, real estate, and even cryptocurrency. Each type requires a unique approach to monitoring and evaluating performance.

Stocks, How to track your investments

Stocks represent ownership in a company and are traded on stock exchanges. Tracking stock investments involves monitoring price movements, company financial reports, and overall market trends. Investors often use fundamental and technical analysis to assess the value of their stock holdings.

Bonds

Bonds are debt securities issued by governments or corporations. Tracking bond investments involves monitoring interest rates, credit ratings, and maturity dates. Investors need to keep track of changes in the bond market to make informed decisions about their bond holdings.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities. Tracking mutual fund investments requires monitoring the fund’s performance, expenses, and investment objectives. Investors should regularly review their mutual fund holdings to ensure they align with their financial goals.

Real Estate

Real estate investments involve owning physical properties such as residential or commercial buildings. Tracking real estate investments includes monitoring property values, rental income, expenses, and market trends. Investors need to stay informed about the real estate market to make strategic decisions regarding their property holdings.

Cryptocurrency

Cryptocurrency investments involve digital assets like Bitcoin and Ethereum. Tracking cryptocurrency investments requires monitoring price volatility, market capitalization, and regulatory developments. Investors should be aware of security risks and stay informed about the evolving nature of the cryptocurrency market.

Tools and Platforms for Tracking

![]()

When it comes to tracking investments, there are several tools and platforms available to help you stay organized and informed. These tools can range from simple apps to more sophisticated software programs, each offering unique features to cater to different investment needs.

Enhance your insight with the methods and methods of Gold and precious metals investment.

Popular Investment Tracking Apps and Software

- Personal Capital: This app offers a comprehensive dashboard to track investments, retirement accounts, and overall financial health.

- Mint: Mint is a budgeting app that also allows users to track investments and analyze their portfolio performance.

- Morningstar: Known for its investment research and analysis tools, Morningstar provides in-depth data on a wide range of investments.

- Quicken: Quicken is a popular software program that offers investment tracking features along with budgeting and financial planning tools.

Features to Look for in an Ideal Investment Tracking Tool

- Portfolio Performance Analysis: Look for tools that provide detailed performance metrics for your investments, including returns, volatility, and benchmarks.

- Automatic Data Sync: Choose a tool that can automatically sync with your financial accounts to ensure up-to-date information.

- Customization Options: Find a tool that allows you to customize your portfolio and track specific investments according to your preferences.

- Alerts and Notifications: Opt for a tool that offers alerts for important events such as price changes, dividends, or portfolio rebalancing opportunities.

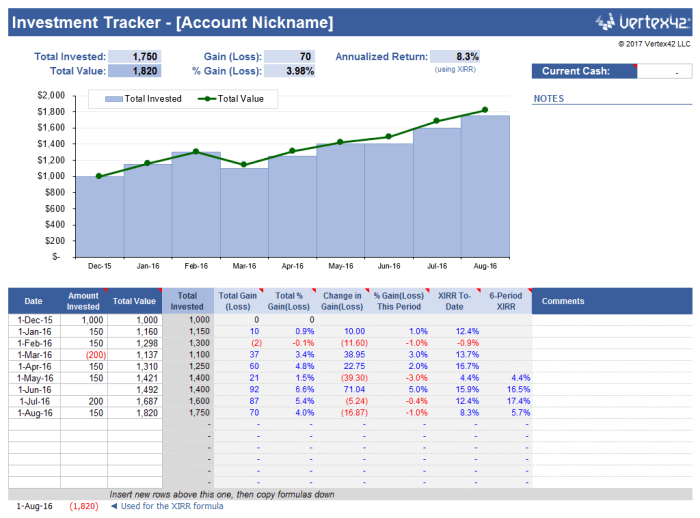

Pros and Cons of Using Excel Spreadsheets for Manual Tracking

While Excel spreadsheets can be a cost-effective way to track investments, there are both advantages and disadvantages to consider.

- Pros:

- Customization: Excel allows for complete customization of tracking sheets to suit individual preferences.

- Control: Users have full control over the data input and organization within the spreadsheet.

- Cost: Excel is often readily available and requires no additional subscription fees.

- Cons:

- Manual Entry: Tracking investments in Excel requires manual data entry, which can be time-consuming and prone to errors.

- Limited Analysis: Excel may not offer advanced analytics or performance tracking compared to dedicated investment tracking tools.

- Lack of Automation: Excel does not provide automatic data updates or alerts, requiring users to manually input and update information.

Setting Up a Tracking System

Setting up a tracking system for your investments is crucial to monitor their performance and make informed decisions. Here is a step-by-step guide on how to set up an investment tracking system:

Organizing Investment Portfolios

- Create a spreadsheet or use a financial tracking tool to list all your investments.

- Categorize your investments based on asset type, such as stocks, bonds, real estate, or other assets.

- Include important details like the purchase price, quantity, current value, and any dividends or interest received.

- Regularly update the tracking system with new investments and changes in the market value of existing investments.

Sample Investment Tracking Template

| Asset Type | Purchase Price | Current Value | Quantity |

|---|---|---|---|

| Stocks | $50 | $60 | 100 |

| Bonds | $1,000 | $1,050 | 5 |

| Real Estate | $200,000 | $220,000 | 1 |

Monitoring Investment Performance

Investors need to regularly monitor their investment performance to assess the success of their portfolios and make informed decisions. Analyzing key performance metrics, understanding benchmarks, and implementing strategies based on performance data are crucial steps in the investment tracking process.

Analyzing Investment Performance Metrics

Monitoring investment performance involves analyzing various metrics to evaluate the overall health of your portfolio. Some key performance indicators to consider include:

- Return on Investment (ROI): Calculated as the percentage increase in the value of your investment over a specific period.

- Annualized Return: Reflects the average annual return on your investment.

- Sharpe Ratio: Measures the risk-adjusted return of your investment compared to a risk-free asset.

- Standard Deviation: Indicates the volatility of your investment returns.

Regularly reviewing these metrics can help you identify trends, assess risk levels, and make informed decisions about your investment strategy.

Significance of Benchmarks in Tracking Investments

Benchmarking involves comparing the performance of your investments against a relevant market index or a specific benchmark. It provides a point of reference to evaluate how well your portfolio is performing relative to the market or a specific investment strategy. Common benchmarks include the S&P 500, Dow Jones Industrial Average, or specific industry indices.

- By comparing your portfolio performance to benchmarks, you can gauge the effectiveness of your investment strategy and identify areas for improvement.

- It helps you set realistic performance goals and measure the success of your investments over time.

Strategies for Adjusting Investment Portfolios

Based on performance data and benchmark comparisons, investors can implement strategies to adjust their investment portfolios:

- Rebalancing: Periodically realigning your portfolio to maintain your desired asset allocation and risk tolerance.

- Diversification: Spreading investments across different asset classes to reduce risk and improve overall returns.

- Tax-Loss Harvesting: Selling investments at a loss to offset capital gains and minimize tax liabilities.

- Performance-Based Adjustments: Making strategic changes to your portfolio based on performance metrics and market conditions.

Regular monitoring of investment performance, benchmark comparisons, and strategic adjustments are essential for optimizing your investment portfolio and achieving your financial goals.

Tracking Taxes and Fees

When it comes to tracking your investments, it is crucial to consider taxes and fees that can impact your overall returns. Understanding how to track these costs can help you make informed decisions and optimize your investment strategy.

Tracking Taxes on Investments

- One of the key aspects of tracking taxes on investments is to keep a record of capital gains and losses. This includes both short-term and long-term gains, which are taxed at different rates.

- It is important to be aware of the tax implications of selling investments, as this can affect your overall tax liability. For example, selling an investment after holding it for less than a year may result in higher taxes compared to holding it for over a year.

- Tracking dividends and interest income is essential, as these are also subject to taxation. Understanding how these earnings are taxed can help you plan ahead and minimize tax obligations.

Tracking Investment Fees

- Fees associated with investments, such as management fees, transaction costs, and advisory fees, can eat into your investment returns over time. It is important to track these fees to understand their impact on your overall portfolio performance.

- High fees can significantly reduce your investment returns, so it is crucial to compare fee structures across different investment options and choose investments with lower costs whenever possible.

- Tracking fees effectively involves keeping a detailed record of all costs associated with your investments and regularly reviewing them to ensure you are not paying more than necessary.

In conclusion, tracking your investments is crucial for financial success. By following the guidelines Artikeld in this comprehensive guide, you can effectively monitor your investments and make informed decisions to optimize your portfolio. Stay diligent and watch your investments grow!