How to invest in bonds: Discover the ins and outs of bond investment, from understanding the basics to making informed decisions for your portfolio.

Delve into the world of bonds and unlock the potential benefits that come with this investment strategy.

Understanding Bonds

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png?w=700)

When it comes to investing, bonds are an essential asset class to consider. Bonds are essentially loans made by an investor to a borrower, typically a corporation or government entity. In return, the borrower promises to repay the principal amount along with interest over a specified period. Unlike stocks, which represent ownership in a company, bonds represent debt.

Types of Bonds

There are several types of bonds available for investment, each with its own unique characteristics:

- Government Bonds: Issued by governments to fund public spending.

- Corporate Bonds: Issued by companies to raise capital for various purposes.

- Municipal Bonds: Issued by state and local governments to fund public projects.

- Agency Bonds: Issued by government-sponsored enterprises like Fannie Mae and Freddie Mac.

- High-Yield Bonds: Also known as junk bonds, these offer higher yields but come with increased risk.

Risks Associated with Investing in Bonds

Investing in bonds comes with its own set of risks, including:

- Interest Rate Risk: Bond prices are inversely related to interest rates, so rising rates can lead to a decrease in bond values.

- Credit Risk: The risk that the issuer may default on payments, especially for lower-rated bonds.

- Inflation Risk: If inflation rises, the purchasing power of bond returns may decrease.

- Liquidity Risk: Some bonds may be less liquid, making it challenging to sell them at a favorable price.

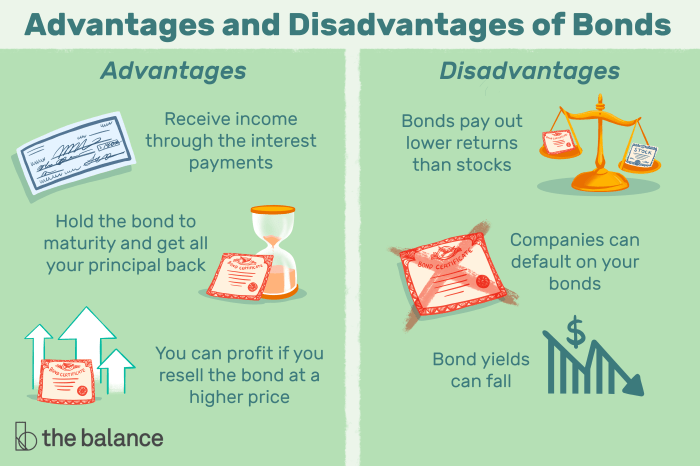

Benefits of Investing in Bonds

Investing in bonds offers several advantages that can enhance an investment portfolio and provide a stable income stream over time.

Potential Returns of Bonds

- Bonds typically offer fixed interest payments at regular intervals, providing investors with a predictable income stream. This can be particularly beneficial for those seeking stable returns.

- Compared to other investment options like stocks, bonds generally have lower volatility, reducing the risk of large fluctuations in value. This stability can be attractive to risk-averse investors looking to preserve capital.

- Bonds can act as a hedge against stock market downturns, as they tend to perform differently under various economic conditions. Diversifying a portfolio with bonds can help mitigate overall risk.

- Depending on the type of bonds chosen, investors may benefit from tax advantages, such as tax-exempt interest on municipal bonds. This can enhance the after-tax returns of bond investments.

- In times of economic uncertainty or market turbulence, bonds are often considered a safe haven asset, providing a reliable source of income and capital preservation.

Factors to Consider Before Investing: How To Invest In Bonds

When considering investing in bonds, there are several factors that you should evaluate to make informed decisions. These factors can have a significant impact on the performance and risk associated with your bond investments.

Interest Rates Impact on Bond Prices

Interest rates play a crucial role in determining bond prices. When interest rates rise, bond prices typically fall, and vice versa. This is because new bonds issued at higher rates make existing bonds with lower rates less attractive in the secondary market. Therefore, it is essential to consider the current interest rate environment and its potential impact on the value of your bond investments.

Importance of Credit Ratings

Credit ratings are assessments of a bond issuer’s creditworthiness, indicating the likelihood of default. Higher credit ratings imply lower risk of default, but they often come with lower yields. On the other hand, lower-rated bonds offer higher yields but carry higher default risk. It is crucial to carefully evaluate credit ratings when selecting bonds to ensure they align with your risk tolerance and investment objectives.

How to Invest in Bonds

Investing in bonds can be a great way to diversify your investment portfolio and generate a steady stream of income. Here are the steps involved in purchasing bonds and some tips on building a diversified bond portfolio.

Methods of Buying Bonds, How to invest in bonds

When it comes to buying bonds, there are a few different methods you can consider:

- Purchasing through a broker: One common way to buy bonds is through a brokerage firm. Brokers can help you navigate the bond market and find the right bonds for your investment goals.

- Buying online: Many investors choose to buy bonds online through various platforms. This option offers convenience and accessibility, allowing you to research and purchase bonds from the comfort of your own home.

Building a Diversified Bond Portfolio

Diversification is key to managing risk when investing in bonds. Here are some tips for building a diversified bond portfolio:

- Invest in bonds with different maturity dates: By spreading out your investments across bonds with varying maturity dates, you can reduce the impact of interest rate changes on your portfolio.

- Consider bonds from different issuers: Investing in bonds issued by various entities, such as governments, corporations, and municipalities, can help spread out credit risk.

- Explore bonds from different sectors: Diversifying across sectors like government, corporate, municipal, and international bonds can provide additional protection against sector-specific risks.

In conclusion, mastering the art of investing in bonds can open up a world of financial opportunities and stability. Dive in and start building your bond portfolio today.

In this topic, you find that Cryptocurrency investment opportunities is very useful.