Dividend stock investing is a powerful strategy for generating passive income and building long-term wealth. By focusing on companies that pay out dividends to their shareholders, investors can benefit from regular payouts and potential stock appreciation. Let’s delve into the world of dividend stock investing and explore the key aspects to consider for success in this investment approach.

Understanding Dividend Stock Investing

Dividend stock investing involves purchasing shares of companies that pay out dividends to their shareholders on a regular basis. These dividends are a portion of the company’s profits distributed to shareholders as a reward for holding onto the stock.

Concept of Dividends

Dividends are typically paid in cash, although they can also be in the form of additional shares of stock. Companies that pay dividends are often more stable and mature, as they are able to generate consistent profits over time. Investors can choose to reinvest these dividends to purchase more shares or receive them as income.

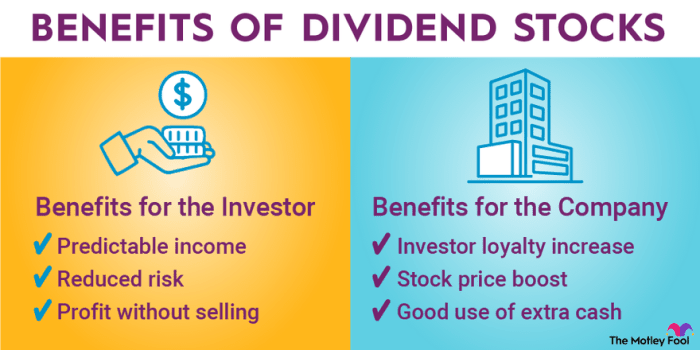

Benefits of Investing in Dividend-Paying Stocks

- Steady Income: Dividend-paying stocks provide a reliable source of income for investors, especially those looking for regular payouts.

- Historical Performance: Dividend-paying stocks have historically outperformed non-dividend-paying stocks, providing attractive returns over the long term.

- Lower Volatility: Companies that pay dividends tend to be more stable, which can help reduce overall portfolio volatility.

- Compounding Returns: Reinvesting dividends can help accelerate the growth of an investment portfolio through the power of compounding.

- Inflation Hedge: Dividends can act as a hedge against inflation, as companies may increase dividend payouts over time to keep up with rising prices.

Selecting Dividend Stocks

When selecting dividend stocks, investors must consider various factors to ensure they choose the right investments for their portfolio. Key factors to consider include the company’s financial stability, dividend yield, dividend growth rate, payout ratio, and overall performance in the market.

High Dividend Yield Stocks vs. Dividend Growth Stocks

High dividend yield stocks are companies that pay out a high percentage of their earnings to shareholders in the form of dividends. While these stocks may offer attractive current income, they may not have much room for dividend growth in the future. On the other hand, dividend growth stocks are companies that have a history of increasing their dividends over time. These stocks may offer lower initial yields but have the potential for significant dividend growth in the long run.

- High Dividend Yield Stocks:

- Offer high current income

- May have limited growth potential

- Can be riskier if the company’s financial health is not stable

- Dividend Growth Stocks:

- Provide potential for increasing income over time

- Can outperform high yield stocks in the long term

- Indicate strong financial health and stability

Popular Industries for High Dividend-Paying Stocks

Some popular industries known for high dividend-paying stocks include:

- Utilities: Companies in the utility sector often have stable cash flows and pay out a significant portion of their earnings as dividends.

- Real Estate Investment Trusts (REITs): REITs are known for their high dividend yields due to their tax advantages and requirement to distribute a majority of their income to shareholders.

- Consumer Staples: Companies that produce essential goods like food, beverages, and household products tend to have stable businesses and consistent dividend payments.

- Telecommunications: Telecom companies often have strong cash flows and pay attractive dividends to shareholders.

Risks and Challenges: Dividend Stock Investing

When it comes to dividend stock investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions. Economic conditions, market volatility, and other factors can all impact the performance of dividend stocks.

Risks Associated with Dividend Stock Investing

One of the main risks associated with dividend stock investing is the potential for companies to cut or suspend their dividend payments. This can happen if a company’s financial health deteriorates, leading to a decrease in profits and cash flow available for dividends.

Another risk is the impact of rising interest rates, which can make dividend stocks less attractive compared to other investments. Additionally, dividend stocks are not immune to market fluctuations and can experience price volatility, which may affect overall returns.

Impact of Economic Conditions on Dividend Stocks

Economic conditions, such as inflation, unemployment rates, and GDP growth, can have a significant impact on dividend stocks. For example, during an economic downturn, companies may struggle to maintain their dividend payments due to reduced consumer spending and lower corporate profits.

Conversely, in a strong economy, companies may have the financial stability to increase their dividend payouts, leading to higher returns for investors. It’s important for investors to consider the broader economic environment when evaluating dividend stocks.

Market Volatility and Dividend Payouts

Market volatility can also affect dividend payouts, as stock prices may fluctuate based on market conditions and investor sentiment. During periods of high volatility, companies may be more cautious about increasing or maintaining their dividend payments.

Enhance your insight with the methods and methods of High-return investment options.

Investors should be prepared for the possibility of fluctuating dividend yields and stock prices, especially during uncertain market environments. Diversification and a long-term investment approach can help mitigate the impact of market volatility on dividend stock investments.

Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans, also known as DRIPs, are programs offered by companies that allow investors to reinvest their cash dividends back into additional shares of the company’s stock. Instead of receiving dividend payments in cash, participants in DRIPs receive additional shares of the company’s stock proportionate to the dividends they would have received.

Advantages of Participating in DRIPs

- Automatic and Compound Growth: DRIPs allow for automatic reinvestment of dividends, leading to compound growth over time.

- Cost-effective: Many companies offer DRIPs without additional fees, making it a cost-effective way to reinvest dividends.

- Increased Ownership: By reinvesting dividends, investors can increase their ownership stake in the company, potentially leading to higher returns in the long run.

Disadvantages of Participating in DRIPs

- Tax Implications: Reinvested dividends are still considered taxable income, which can complicate tax reporting for investors.

- Lack of Flexibility: Participating in a DRIP means relinquishing control over when and how dividends are received, as they are automatically reinvested.

- Dilution: As more shares are issued through DRIPs, existing shareholders may experience dilution of their ownership stake in the company.

Companies Offering DRIP Programs

| Company | Symbol | Details |

|---|---|---|

| Johnson & Johnson | JNJ | Offers a DRIP program with optional cash purchases and no fees for reinvesting dividends. |

| The Coca-Cola Company | KO | Provides a DRIP program allowing investors to reinvest dividends in additional shares of the company. |

| Procter & Gamble | PG | Offers a DRIP program with the option to reinvest dividends and purchase additional shares. |

Tax Implications

When it comes to investing in dividend stocks, it is crucial to consider the tax implications that come with receiving dividends. Understanding how dividends are taxed can help investors make informed decisions and maximize their returns.

Tax Treatment of Dividends, Dividend stock investing

- Dividends received from stocks are generally classified into two categories: ordinary dividends and qualified dividends.

- Ordinary dividends are taxed at the investor’s ordinary income tax rate, which can range from 10% to 37% depending on the tax bracket.

- On the other hand, qualified dividends are taxed at the lower capital gains tax rates, which are 0%, 15%, or 20%, again depending on the investor’s tax bracket.

- For a dividend to be considered qualified, the investor must meet certain holding period requirements and the dividend must be paid by a U.S. corporation or a qualified foreign corporation.

Tax-Efficient Strategies

- One tax-efficient strategy for dividend stock investing is to hold qualified dividends in taxable accounts and ordinary dividends in tax-advantaged accounts like IRAs or 401(k)s.

- Another strategy is to focus on investing in stocks that pay qualified dividends to take advantage of the lower tax rates.

- Consider using tax-loss harvesting to offset gains from dividend income and reduce the overall tax liability.

In conclusion, dividend stock investing offers a unique opportunity to grow your wealth while receiving regular payouts. By carefully selecting dividend-paying stocks, understanding the risks involved, and strategizing tax-efficient investment plans, investors can set themselves up for financial success in the long run. Start your journey into dividend stock investing today and unlock the potential for a brighter financial future.