Credit card balance transfer offers set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. With examples from popular credit card companies and insights into maximizing benefits, this guide is a must-read for anyone looking to take control of their finances.

Overview of Credit Card Balance Transfer Offers

Credit card balance transfer offers are promotions provided by credit card companies that allow cardholders to transfer their existing credit card debt from one card to another with a lower interest rate or sometimes even at a 0% interest rate for a limited period.

You also will receive the benefits of visiting Trading psychology in forex today.

Popular Credit Card Companies Offering Balance Transfer Promotions

- Chase

- Citi

- Bank of America

- Discover

Benefits of Utilizing Balance Transfer Offers for Managing Debt

- Lower Interest Rates: Balance transfer offers often come with lower interest rates, allowing cardholders to save money on interest payments.

- Consolidation of Debt: By transferring multiple credit card balances onto one card, cardholders can simplify their debt management and potentially pay it off faster.

- Introductory 0% APR: Some balance transfer offers come with an introductory period of 0% APR, giving cardholders a temporary break from accruing interest on their transferred balance.

- Improved Credit Score: Successfully managing a balance transfer offer can help improve a cardholder’s credit score by reducing overall debt and making consistent payments.

How Credit Card Balance Transfers Work

When it comes to credit card balance transfers, it’s essential to understand the process involved, the fees associated, and the terms and conditions before initiating a transfer.

Transferring a Credit Card Balance

Transferring a credit card balance to another card typically involves contacting the new credit card issuer and providing them with the details of your existing credit card account. The new issuer will then initiate the transfer process, paying off the balance on your old card and transferring it to the new card.

Typical Fees Associated with Balance Transfers

- Balance Transfer Fee: This is a fee charged by the new credit card issuer for transferring your balance. It is usually a percentage of the amount transferred.

- Interest Rate: The new card may offer an introductory 0% APR on balance transfers, but this rate may increase after a certain period.

- Late Payment Fees: Missing a payment on your new card could result in late payment fees.

Understanding Terms and Conditions

Before initiating a credit card balance transfer, it is crucial to carefully review and understand the terms and conditions of the new card. This includes the length of any introductory APR offers, the regular APR after the introductory period, and any other fees or penalties that may apply. Being aware of these terms will help you make informed decisions and avoid any surprises down the line.

Factors to Consider Before Opting for a Balance Transfer

When considering a balance transfer offer, there are several key factors to keep in mind to make an informed decision that suits your financial situation.

Interest Rates

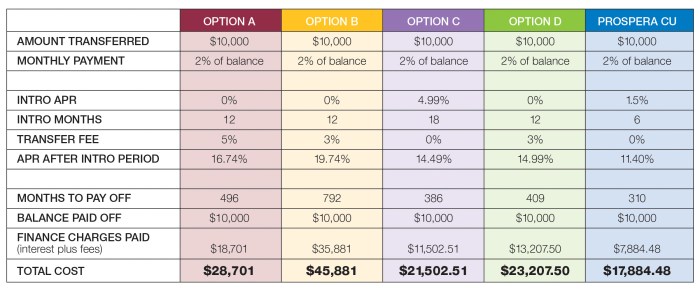

Interest rates play a crucial role in balance transfers. Be sure to understand both the introductory rate and the regular rate that will apply after the promotional period ends. Compare these rates with your current credit card’s interest rate to determine if the transfer will actually save you money in the long run.

Introductory Periods

The length of the introductory period can vary among balance transfer offers. Consider how much time you need to pay off the transferred balance and choose an offer with a suitable timeframe. Keep in mind that some offers may have shorter introductory periods but lower fees, so evaluate your repayment ability accordingly.

Fees

Balance transfer fees are typically charged as a percentage of the transferred amount. While some offers may advertise a 0% APR, they may still have fees attached. Calculate these fees to ensure that the transfer is cost-effective compared to your current credit card’s interest charges.

Credit Scores

Your credit score plays a significant role in determining your eligibility for balance transfer offers. Generally, better credit scores result in better offers with lower interest rates and fees. Check your credit score before applying for a balance transfer to gauge your chances of approval and the terms you may receive.

Financial Situation Assessment, Credit card balance transfer offers

Before opting for a balance transfer, it’s crucial to assess your financial situation thoroughly. Consider factors like your income, expenses, and ability to repay the transferred balance within the promotional period. Make sure that a balance transfer aligns with your financial goals and doesn’t worsen your debt situation.

Maximizing the Benefits of Credit Card Balance Transfer Offers

When taking advantage of credit card balance transfer offers, it is essential to have a strategic plan in place to make the most of the benefits. By effectively managing transferred balances, leveraging promotional interest rates, and maintaining good credit, you can optimize your financial situation and work towards paying off debt faster.

Managing Transferred Balances

- Create a repayment plan: Artikel a realistic timeline to pay off the transferred balance before the promotional period ends. Set a monthly budget and stick to it to avoid accumulating more debt.

- Avoid new purchases: Focus on paying off the existing balance without adding new charges to the card. This will prevent your debt from increasing and help you achieve your goal faster.

- Monitor your spending: Keep track of your expenses to ensure you stay within your budget. Cut back on non-essential purchases to allocate more funds towards paying off the transferred balance.

Leveraging Promotional Interest Rates

- Pay more than the minimum: Take advantage of the low or 0% interest rate by paying more than the minimum amount due each month. This will help you reduce the principal balance faster and save on interest charges.

- Set up automatic payments: Avoid missing payments by setting up automatic transfers from your bank account to your credit card. This will ensure timely payments and help you stay on track with your repayment plan.

- Transfer again if needed: If you are unable to pay off the balance within the promotional period, consider transferring it to another card with a new offer. This can help you continue to benefit from low interest rates and avoid accruing high interest charges.

Maintaining Good Credit

- Pay on time: Make sure to pay your credit card bills on time to avoid late fees and negative marks on your credit report. Timely payments demonstrate responsible financial behavior and help maintain a good credit score.

- Monitor your credit utilization: Keep your credit utilization ratio low by not maxing out your credit card limits. This shows lenders that you can manage credit responsibly and can positively impact your credit score.

- Regularly check your credit report: Monitor your credit report for any errors or inaccuracies that could negatively affect your credit score. Dispute any incorrect information to ensure your credit report reflects your true financial standing.

In conclusion, Credit card balance transfer offers provide a powerful tool for managing debt and achieving financial freedom. By understanding the process, key factors to consider, and strategies for maximizing benefits, individuals can take charge of their financial well-being and pave the way for a brighter future.